My older brother and I inherited individual retirement accounts (IRAs) from Vanguard when our younger brother passed away in 2012. Except for taking the required minimum distribution (RMD) every December, I never interact with the company. Ever. The statements arrive, I file them, and, once a year (inevitably in December), I phone in my RMD instructions.

Vanguard wrote me in June that the legacy investment platform which hosted the conduit IRA account would shutter on December 31, 2025. Vanguard advised me to move the IRA’s investments to a brokerage account on its replacement platform before then. I sought to do so yesterday.

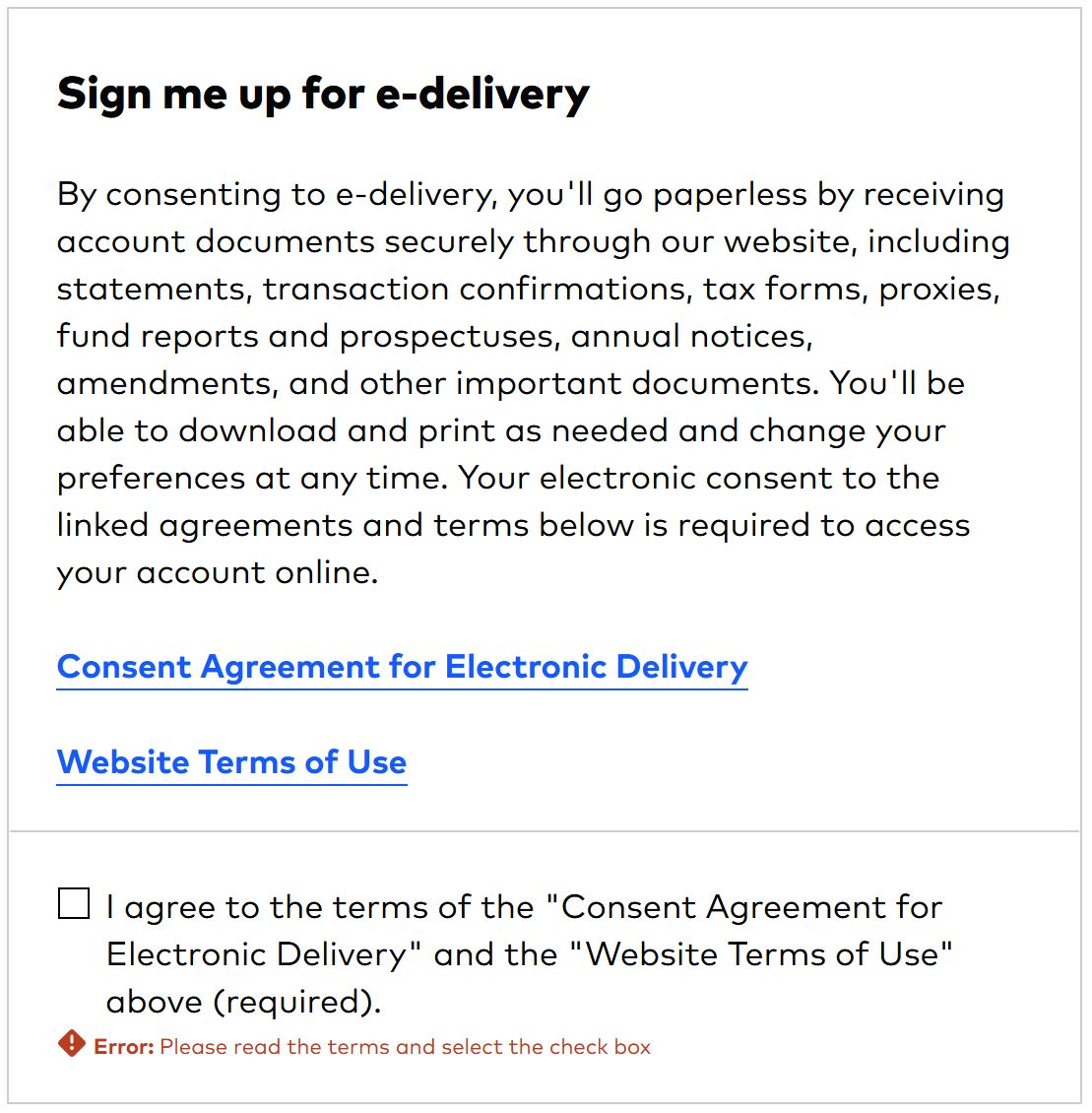

Per Vanguard’s written instructions, I began registering online at the URL designated by Vanguard. There were several online pages of forms – personal identifying information, account numbers, the usual stuff – then a checkbox: “Sign me up for e-delivery.” The only way to proceed was to check the box. If I left the box blank, I received a red error message, “Error: Please read the terms and select the check box”, and was denied further access.

For me, that was a deal breaker. These were the stated conditions for “going paperless”:

“By consenting to e-delivery, you'll go paperless by receiving account documents securely through our website, including statements, transaction confirmations, tax forms, proxies, fund reports and prospectuses, annual notices, amendments, and other important documents. You'll be able to download and print as needed and change your preferences at any time. Your electronic consent to the linked agreements and terms below is required to access your account online.”

In other words, I would no longer receive alerts that a RMD deadline was approaching, calculations of what my upcoming RMD would be, or even a year-end IRS Form 1099R unless I, first, remembered the username, password, and email address I used just once every 365 days, and, second, possessed the same smartphone and smartphone number I used to double-authenticate my account when (or rather if) I registered online. I have broken or lost three cell phones during the last two years. And, because my previous phone was unlocked when it was stolen from a toilet stall at Home Depot by the next “patron”, I deactivated and replaced the phone number. I am absolutely certain other such “senior moments” are possible. The point is, I depend heavily on paper documents and reminders, especially for low-traffic accounts.

I called Vanguard to assess my options. At first, the agent did not believe me. She insisted I was mistaken; the “go paperless” checkbox was optional. After I walked her through each of the forms and repeatedly generated the error message, “Error: Please read the terms and select the check box”, the flummoxed agent went off script and ad-libbed. “Oh, you’ll have the option to deselect that option later.” 39 years of legal experience taught me otherwise.

I said I would draft a notarized letter of instruction, instructing Vanguard’s account “transition team” to set up a brokerage account in my name on their new platform and transfer my investments from the old form. If they could not accommodate the request, I would visit their office in person and transfer the funds to a competitor. The agent at last exclaimed, “Oh, we have a paper form for transitioning accounts within Vanguard. Would you like me to mail you one?”

“Yes, please,” I replied, and thanked her profusely for her assistance. Just another hour of make-work in our ever-so-efficient digital age.

Meanwhile, my Reuters feed quoted the newly appointed Vanguard CEO as planning to make his company as strong a presence in fixed-income asset management as it is already is in equities. https://www.reuters.com/markets/us/vanguards-new-ceo-eyes-fixed-income-offering-expansion-2024-09-25/

Please, Mr. Ramji, hold that thought for a second. The “go paperless” checkbox in registering a Vanguard account should be optional. A second is all your programmers need to ensure that. As enticing as your new-fangled fixed income products promise to be, they won’t matter if baby boomers like me move their life savings to Fidelity.